Where Did The Money (And Time) Go?

Growing old(er) has a very interesting impact on your life, especially that moment when you pass 35 and the mistakes of your youth begin weighing down on you.

I try to live a life of no regret, focusing more on the lessons learnt than wishful longing. But there’s something sobering about realizing your finances would be in a much better place if you had simply been consistent.

My Red Notebook is filled with calculations, projections, plans, goals and budgets of all sorts, from personal anecdotes to business plans. But many of them – especially the older ones – did not stand the two most important tests of investment: time and patience.

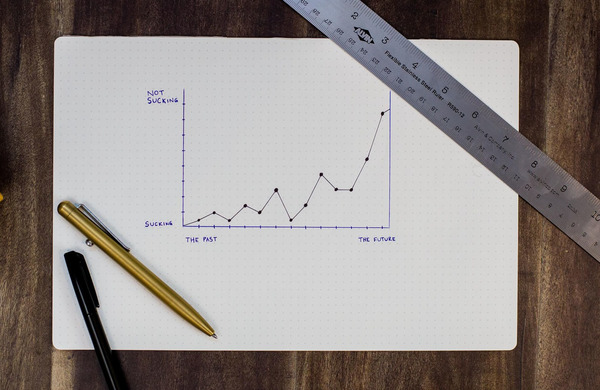

As I mentioned in a post early this week, we overestimate what can be achieved in one year and underestimate what can be achieved in 10 years. We also underestimate how quickly time flies by; 10 years go by in the blink of an eye.

I made a series of bad investments in my late twenties, and they were bad investments simply because I was impatient. I wanted to get great returns in a short time, which meant I took higher risks hoping for high value returns. What happened instead was that the very high risk appetite led to high losses. 100% losses, to be precise. [insert tears of pain]

What I know now, is that – with very rare exceptions – slow, steady compounded growth beats frantic, high-risk investment any day. The problem is that we’re all so excited by the prospect of quick returns on an investment that we keep focusing on the hypothetical gold at the end of the rainbow and ignoring the losses along the way. And because we keep increasing risk levels (like leverage) to make up for the losses, we expose ourselves to higher risk and subsequently, even higher losses, creating a vicious cycle of financial ruin.

A Simple Example on A Compounded Investment

Disclaimer: In this example, we’re using a $500 baseline which can be very modest or very large, depending on which country you live in. The principles stay the same. We’re also using a convenient interest rate comparable to what some funds and banks offer here in Uganda.

So, let’s say Janet starts saving when she’s 25. She saves $500 per year for 35 years, and puts it in an account that earns 10% interest per year.

She compounds each year by leaving the annual interest in the account, but is still adding an additional $500 each year into the account.

At 60 years, Janet has $163,100.

But, if Janet starts saving when she’s 35, and follows the same process, by the time she’s 60, Janet will have $59,500. That ten-year delay in saving has cost Janet $104,000!

Of course, none of this factors in inflation and taxes (which could reduce the value of the investment) or Janet’s increased capacity to earn or save (which would exponentially increase those numbers), but it’s still indicative of the comparative difference time makes.

The Psychology of Compounding Money

We shared a Daily Read article this week from the Psychology of Money, an article that blew me completely away with its truths that I spent the entire week reflecting on its lessons. Here are a few that stood out for me, starting with this interesting perspective on investing.

Investing is not the study of finance. It’s the study of how people behave with money. And behavior is hard to teach, even to really smart people. You can’t sum up behavior with formulas to memorize or spreadsheet models to follow. Behavior is inborn, varies by person, is hard to measure, changes over time, and people are prone to deny its existence, especially when describing themselves.

I started appreciating the true value of compounding a few years ago when I was reflecting on how much time and money I had wasted looking for quick returns on some investment or idea that looked awesome on paper. After years of failure, it became apparent that patience, consistency and compounding with low-risk investments would have gotten me much better returns (and much less psychological trauma).

Underappreciating the power of compounding, driven by the tendency to intuitively think about exponential growth in linear terms.

The punchline of compounding is never that it’s just big. It’s always – no matter how many times you study it – so big that you can barely wrap your head around it.

I have heard many people say the first time they saw a compound interest table – or one of those stories about how much more you’d have for retirement if you began saving in your 20s vs. your 30s – changed their life. But it probably didn’t. What it likely did was surprise them, because the results intuitively didn’t seem right. Linear thinking is so much more intuitive than exponential thinking.

The sobering realization about compounding money is that it works better when you start early, or immediately. And the earlier you start, the better. Like we’ve seen in the example I shared above, the difference between a compounded savings plan started in your twenties vs. in one your thirties can be mind boggling, and the older you get the harder it becomes. Which means there is no better time to start a compounded savings plan than today.

And remember, once you start on a savings or investment plan, especially a compounded one, do whatever it takes to never, ever interrupt it until it’s reach the target goal.

A tendency toward action in a field where the first rule of compounding is to never interrupt it unnecessarily.

When volatility is guaranteed and normal, but is often treated as something that needs to be fixed, people take actions that ultimately just interrupts the execution of a good plan. “Don’t do anything,” are the most powerful words in finance. But they are both hard for individuals to accept and hard for professionals to charge a fee for. So, we fiddle. Far too much.

Read This: More About Money

Compounding is just one of the 20 lessons I shared this week on our website. Check out the other lessons here: 20 Lessons on Personal Finance From The Last 20 Years.

Below are the articles on money that we’re reading and sharing this week on our social media. Show some love by following, sharing and connecting with us on Twitter, Facebook, Instagram, YouTube, and LinkedIn.

- Are You Paying Yourself First? The Money Habit That Can Boost Wealth

- 7 Money Lessons from The Richest Man in Babylon

- 15 Practical Budgeting Tips

Finally, the article on the Psychology of Money is truly fantastic. Check it out when you get the time.